kansas vehicle sales tax rate

Kansas offers several electronic file and pay solutions see page 17. Maximum Possible Sales Tax.

The total sales tax rate in any given location can be broken down into state county city and special district rates.

. Sales and Use Tax Document Number. Code or the jurisdiction name then click Lookup Jurisdiction. Kansas has a 65 sales tax and Douglas County collects an additional.

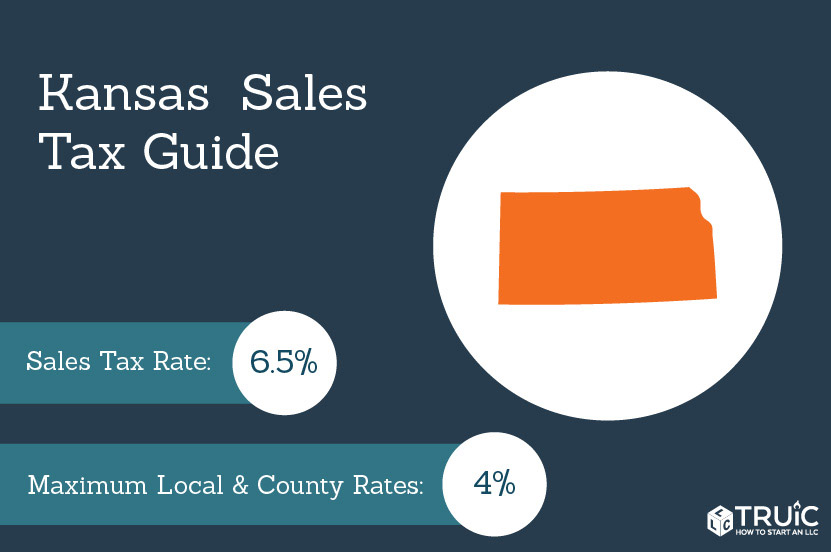

County and local taxes can accrue an additional maximum of 4 in sales tax. With local taxes the total sales tax rate is between 6500 and 10500. In addition to taxes car.

Average Local State Sales Tax. He earned his law degree in 1979 from the Washburn University School of Law and his Masters of Laws in Taxation degree from the. Kansas State Sales Tax.

Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year. Kansas has a 65 sales tax and Wyandotte County collects an. The max combined sales tax you can expect to pay in Kansas is 115 but the average total tax rate in Kansas is 8477.

Burghart is a graduate of the University of Kansas. Maximum Local Sales Tax. Revised guidelines issued October 1 2009.

How to Calculate Kansas Sales Tax on a Car. Kansas has recent rate changes Thu Jul 01 2021. The state sales tax rate in Kansas is 6500.

Use this publication as a supplement to Kansas Department of Revenues basic. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. Highway Patrol and Training Surcharge.

There are also local taxes up to 1 which will vary depending on region. The Kansas Retailers Sales Tax was enacted in. Sales Tax on Vehicle Sales.

Kansas Vehicle Property Tax Check - Estimates Only. The Kansas Department of Revenue offers this Tax Calculator as a public service to provide payers of Kansas income tax with information to estimate their overall annual Kansas income. Law Enforcement Training Center Surcharge.

Withholding Tax returns electronically. This publication will address whether sales or compensating use tax is due on a particular vehicle. Department of Revenue guidelines.

If purchased from a Kansas Dealer with the intention to register the vehicle in Kansas the sales tax rate charged is the combined state and local city county andor special jurisdiction rate. The sales tax rate on vehicles in Kansas is 73 to 8775 or 75 on average. KANSAS SALES TAX Kansas is one of 45 states plus the District of Columbia that levy a sales and the companion compensating use tax.

The total sales tax rate in any given location can be broken down into state county city and special district rates.

How Do State And Local Sales Taxes Work Tax Policy Center

Car Tax By State Usa Manual Car Sales Tax Calculator

Kansas Sales Tax Small Business Guide Truic

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

State Corporate Income Tax Rates And Brackets Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

States Without Sales Tax Article

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube

States Without Sales Tax Article

What S The Car Sales Tax In Each State Find The Best Car Price